Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Churches need software that can track contributions and expenses in an organized way. At minimum it should handle fund-based accounting (tracking multiple funds or programs) and donation tracking so tithes and offerings are recorded accurately. Key features include:

Each church’s needs vary, but expense tracking, donation tracking, and report generation are non-negotiable basics breezechms.com. (For more on choosing software, see our Good Messages post “The Best 5 Church Accounting Software in the USA”.)

Churches should produce standard financial statements for transparency. These include:

Having these statements (often called financial reports) helps your leadership and donors see the church’s fiscal health and stewardship. Most church software can generate these automatically. You may also want donor giving reports or budget vs. actual reports as needed for your church’s accountability.

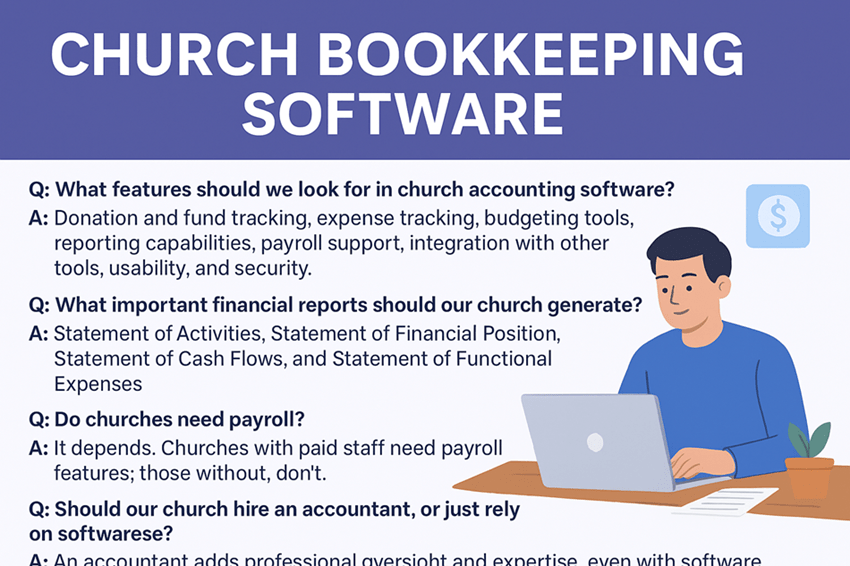

Figure: A church treasurer or volunteer using financial software (or ledgers) to track contributions and expenses.

It depends on whether you have paid staff. If your church employs anyone – pastors, secretaries, custodians, etc. – you must handle payroll (salary, taxes, withholding). Many church accounting packages include payroll modules: for example, Shelby Financials has a dedicated church payroll tool for clergy and staff. Aplos also offers integrated payroll services for churches. By contrast, some systems (e.g. ChurchTrac) do not include payroll, meaning you’d use separate payroll software or an accountant.

If your church has no paid employees (all volunteer-run), then payroll isn’t needed. But for any staff, make sure your software or accounting system can process payroll and issue W-2s, or else plan to outsource that function.

Bookkeeping software is a powerful tool, but expert oversight is still wise. As Jitasa explains, “working with an accountant can take the burden of financial management off your team”. Even small churches often use a volunteer or part-time accountant to check records, ensure compliance, and provide advice. Options include:

In short, don’t entirely “ignore” the human element. An accountant (staff or outsourced) can review the software’s reports, prepare tax filings (e.g. W-2s for staff), and ensure funds are handled properly. Software reduces work and errors, but an experienced bookkeeper/accountant adds oversight and confidence for your leadership.

For more tips on church finances and software, see our Good Messages blog’s Church Accounting Q&A posts and reviews of church accounting systems.